The demonetization of Rs.500 and Rs.1000 currency notes was a measure implemented by the Indian government on 8th November 2016. Demonetization is referred to the act of stripping a takes place a change in the national currency. The old currency note must be withdrawn and replaced with new currency notes. Demonetisation resulted in the ceasing of the usage of all banknotes of the mentioned denominations in India with effect from 9th November 2016. The government claimed that it was an effort made to crush the circulation of black money and fake currency notes in the India’s economy. India is traditionally a cash-based economy and it has experienced an increase in card-based and online payments in recent days. Although the Government of India and the regulators in the country took steps to popularize cashless transactions across the nation, but the country continued to be a high-cash-usage one. Due to the fact that the majority of currency notes in circulation are of INR 100 and of lesser denominations, India has suddenly started seeing an enhancement in the online transactions, card payments and mobile e-wallets in handling day to day expenses.

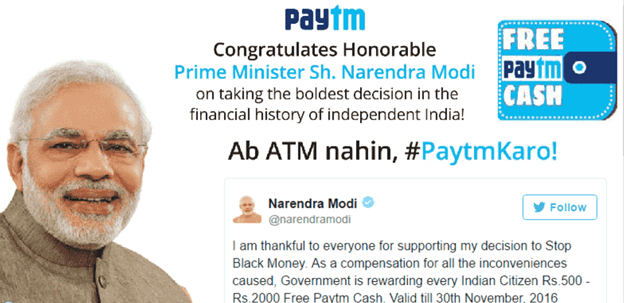

Paytm is an Indian e-commerce company. It was launched in the year 2010. It was founded and incubated by One97 Communications. The firm facilitates in mobile recharging, bill payments, booking buses for traveling, movie ticket booking and meeting various other shopping requirements. Paytm can be accessed both from the web browser and also via the app on any mobile running on Android, Windows and iOS operating systems. In the year 2014, Paytm introduced e-wallet called Paytm Wallet, which later on became India’s largest mobile payment service platform. A sudden rise in the usage of the service offered by Paytm took place due to the event of demonetization that had occurred in the country in the month of November of 2016. Paytm wallets help users to book air tickets and cabs. Mobile recharges and payments of DTH & broadbands are very easy with Paytm wallets. Electricity bills, fuel charges, and other utilities can also be paid through the same. Paytm wallets allow the users to add their Credit/Debit cards and link their bank accounts to them. One has to make use of QR code to send and receive payments with ease. Zingoy, an e-commerce business house provides Paytm cashback deals to its users to their delight which work on Paytm’s website and app.

Paytm has added eight million new users in the two weeks since the government of India announced demonetization in the country. The inconvenience that was caused to people due to such strict measure adopted by the Indian government has pushed people to sign up for digital wallets or e-wallets.Vijay Shekhar Sharma, the Chief Executive Officer (CEO) of Paytm, has recently said at a news conference in New Delhi that this is the golden age of investment in digital payments in India.

He also said that Paytm is adding around 5 lakh new users daily after the announcement of demonetization was made by Mr.Modi. Zingoy has partnered with Paytm and several other e-commerce entities operating in India. It provides a plethora of deals and attractive coupons in terms of cashback and discounts to the delight of its users to make purchases. These deals and coupons are applicable on shopping of various items like women’s t-shirts, booking of cab rides, buying movie tickets, paying electricity bills, etc. So without wasting any more time please visit the website of Zingoy.com

to know about a plethora of discount offers cashback deals and available.